1. Cut down on your grocery budget.

Most people—after they do a budget—are shocked to find out how much they’re actually spending at the grocery store each month. And if you’re the average thrifty American family of four, you’re probably spending around $966.1 Yikes! It’s so easy to walk through those aisles, grabbing a bag of Oreos here and a few bags of chips there, and then top it off with the fun goodies at the register. But those little purchases (aka budget busters) add up quite a bit and end up blowing the budget every single month.

Save money on groceries by planning out your meals each week and taking a good look at what you already have in your pantry before you head to the store. Because why would you want to buy more of what you already have? And if you really want to stick to your list—leave the kids at home.

Want to save money and time? Try online grocery pickup or delivery. Most major grocery stores offer it these days (sometimes even for free), and it can save a ton of money. Picking up your groceries gets rid of the temptation you would’ve had when you caught a whiff of those freshly baked chocolate chip cookies floating through the aisles. In other words, you’re forced to stick to your list and avoid those impulse splurges.

2. Buy generic.

Hands down, one of the easiest ways to save money is to give brand names the boot. In most cases, the only thing that’s better about name-brand products is the marketing. I mean, look at that box! The logo is so fancy! And that’s about where it ends. Generic brands of medicine, staple food items (like rice and beans), cleaning supplies and paper products cost far less than their marked-up name-brand friends—and they work just as well too.

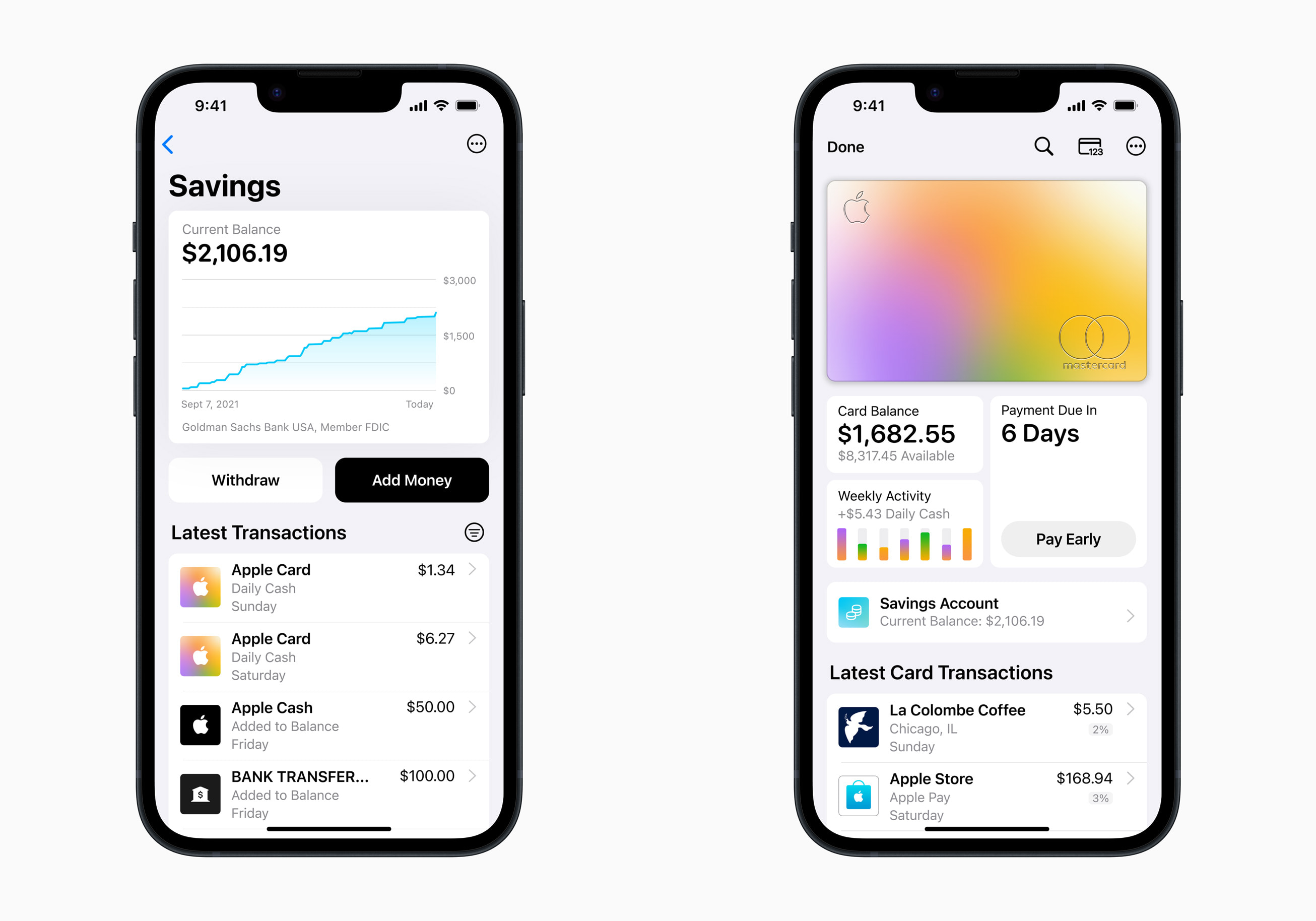

3. Save money automatically.

Did you know that you can save money without thinking about it? Yup—you can set up your bank account to automatically transfer funds from your checking account into a savings account every month. If that sounds scary to you, you can also set up your direct deposit to automatically transfer 10% of each paycheck into your savings account. Boom!

4. Reduce energy costs.

Did you know that you can save money on your electric bill just by making a few tweaks to your home? Start with some simple things like taking shorter showers (nope, we didn’t say fewer), fixing leaky pipes, washing your clothes in cold water, and installing dimmer switches and LED lightbulbs.

While new, energy-efficient appliances are a great way to save money on your electric bill, they’re expensive! But if you work it into your monthly budget, you can save up and pay cash for those improvements over time.

5. Pack lunch (and eat at home).

Get this—the average household spends about $3,030 on food outside of the home each year. That’s $253 per month! Buying lunch a few times a week may seem harmless in the moment (especially when your favorite restaurant is walking distance from your office), but you can save quite a bit of money just by packing a lunch.

Not only that but a lot of times you can buy a solid week’s worth of groceries for the same price as two dinner meals out. Instead, prepare your food at home and watch your savings pile up month after month.

6. Take advantage of your retirement savings plan.

If your employer offers a 401(k) match and you aren’t taking full advantage of it, you’re missing out big time! Talk to your HR department to set up an account. But remember, you should wait until you’re completely debt-free (except your mortgage) and have a fully funded emergency fund of three to six months before you start saving and investing for retirement.

7. Lower your cell phone bill.

If your monthly cell phone bill competes with your monthly grocery budget, it’s time to find ways to cut back. Save money on your cell service by getting rid of extras like costly data plans, phone insurance and useless warranties. And don’t be afraid to haggle with or completely switch your provider! It might require a little persistence and research, but the savings are worth it.

8. DIY . . . everything!

Before you shell out the cash to pay for a new backsplash, bench or fancy light fixture, think about doing it yourself! Usually, the cost of materials and a simple Google or YouTube search will save you a ton of money on your latest home project. Plus, you won’t have to pay someone to do something you can most likely do yourself. But if you’re the type who can’t seem to hit the nail on the head, you might want to ask a friend or neighbor for help so you don’t have to spend money on new drywall.

Oh, and when you need to do some DIY work (or any kind of work), borrow whatever tools you need from a friend or neighbor instead of going out and buying it.

9. The library is your friend.

Before you click Add to Cart on that brand-new book, check your local library to see if you can borrow it! Most libraries also have audiobooks and digital copies of your favorite books for rent. It’s an easy way to get your reading in without breaking the bank.

Bonus tip: Look online or visit your local used bookstore for major deals on like-new or even well-loved books . . . for next to nothing!

10. Use cash-back apps and coupons.

Nothing beats a good old-fashioned 20% off coupon when you’re buying something. But did you know there are plenty of cash-back apps out there to help your savings go even further? Check out Ibotta, Rakuten and Honey (a browser extension).

11. Sell everything (that doesn’t bring you joy).

Marie Kondo has the right idea. Declutter the things in your home that you don’t need and are willing to let go of for the sake of your financial future. That vintage chair your aunt gave you? Sell it. That crystal vase you found at an antique shop? Sell it. You’d be surprised at how much clutter you have in your home (that you don’t even use or think about). And the cash you can make on those things can be the difference between living paycheck to paycheck or not.

12. Learn the power of “no” (or “not now”).

We live in a world of instant gratification. Food from our favorite restaurants can be at our door in an hour or less. The show you want to binge is right there at the ready. The ads on social media say you need this, that and the other. Right now. We’re a couple clicks away from satisfying our desires for nearly anything!

But if you can delay some gratification by using the magic of “no” (or “not now”)—you will save so much money. It’s a huge mindset shift to build better spending habits overall. And it’s another way to become a more content person. Savings with a side of mental and emotional health? Yes, please!